AVERAGE EARNINGS OF £54,000 REQUIRED TO BUY A HOME IN THE CITY

Property website, Zoopla has released data to show that first-time buyers now need an average income of £54,000 to purchase a typical property in a UK city. This average income figure has risen by 9% since 2016, largely due to higher property prices.

In the 20 cities that account for more than one-third of the UK’s housing stock, Zoopla found that Liverpool had the lowest gross household income required for first-time buyers, at £26,000. In addition to being named the most affordable city for first-time buyers, Liverpool was also the city with the highest house price growth, at 5% over the 12 months to May.

In contrast, an average household income of £84,000 is needed in London and whilst this may appear unattainably high, it is actually £3,250 less than the amount required in 2016 and the lowest figure for four years.

Outside the capital, Oxford and Cambridge require the highest typical household incomes at £69,000 and £72,000 respectively. However, these were down on £71,000 and £76,000 respectively three years ago.

EDINBURGH’S PRIME PROPERTY MARKET SEES SLOWING PRICE GROWTH

Recent data from Knight Frank shows that annual price growth in Edinburgh was down from 7.6% at the end of Q1 2019, to 4.3% in June. The data also shows a drop of 10% in price growth from the end of 2018.

Edward Douglas-Home, Partner at Knight Frank commented: “A moderation in property values is a sign that, having appeared relatively unaffected by the political uncertainty which has been impacting other prime regional markets since 2016, both buyers and sellers in the city are becoming more cautious.”

Whilst country house prices across Scotland fell in value by 0.1% in Q2 2019, the demand for family houses outside of the city centre has remained robust, especially in traditionally popular areas such as Morningside, Murrayfield and Newington.

The data also indicates that some vendors are in no rush to sell, with new listings across the whole market in Edinburgh being 15% lower in Q2 2019, compared to the same period in 2018.

IMPROVING SENTIMENT AS NEW INSTRUCTIONS HOLD STEADY

Supporting the emergence of a more stable trend across the residential market, a recent survey by Royal Institution of Chartered Surveyors (RICS) shows respondents reported (in net balance terms) a very modest rise in buyer demand and new instructions holding steady throughout June.

Last month, new buyer enquiries were up 10%, which is the first time since November 2016 where survey contributors reported an increase in appetite from potential purchasers.

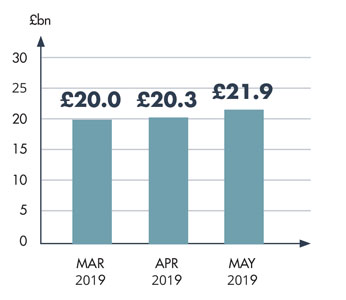

A further sign of stable market activity, according to Savills, is a continued rise in the number of mortgage approvals and increase in Loan to Value (LTV) ratios, with the national average LTV for first-time buyers now standing at 78%. |